Source Products from China: Import Guide & Supplier Playbook

Sourcing from China promises massive cost savings – typically 40-60% lower manufacturing costs than domestic production. But the path is littered with landmines: supplier fraud, communication breakdowns, compliance failures, and logistical nightmares that can erase those savings overnight. This isn’t another generic listicle. This 2025playbook delivers the exact frameworks, scripts, and tools used by professional sourcing agents to build bulletproof supply chains. Follow it, and you’ll negotiate like a pro, avoid costly quality disasters, and master the real landed costs.

Vet NOW: Use our Supplier Scorecard on your top 3 candidates (Sections 4 & 5).

Cost CHECK: Calculate true expenses with our Landed Cost Calculator (Section 9).

Negotiate SMART: Review Cultural Scripts before emailing Chinese suppliers (Section 5).

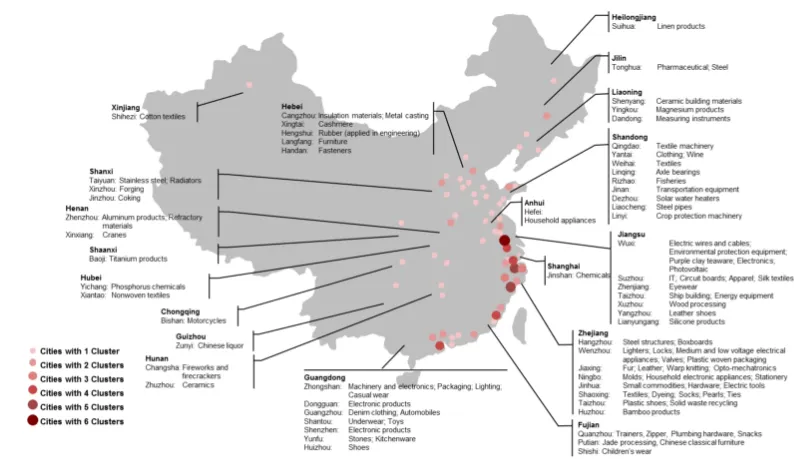

China dominates global manufacturing for a reason:

Cluster Advantages: Shenzhen (electronics), Yiwu (commodities), Zhili (childrenswear) offer unparalleled supply chain density. Sourcing a circuit board? Within 10km in Shenzhen, you’ll find PCB fabricators, component suppliers, and SMT assembly houses.

Scale Economics: Orders over 50,000 units unlock 15-30% cost reductions through raw material bargaining power and dedicated production lines.

The Catch: For low-volume, high-complexity items (e.g., custom machined aerospace parts under 500 units), Eastern Europe or Mexico often offer better TCO due to lower NRE (Non-Recurring Engineering) costs and shipping.

Actionable Insight: Use China for high-volume, modular goods. Explore Vietnam for footwear/textiles, India for pharmaceuticals, Mexico for nearshoring heavy goods.

Skip this = Burn cash. Validate before contacting suppliers:

Reverse Engineer Costs: Tear down competitor products. Weigh components, identify materials (e.g., "Injection Molded PP, 20% glass filler"), estimate labor minutes. Cross-reference with Alibaba Material Costs (2025):

SUS 304 Stainless Steel Sheet: 2.50−2.50−3.20/kg

PC-ABS Plastic Pellet: 2.10−2.10−2.80/kg

Tariff Trap Check: Is your product hit by US Section 301 tariffs? (e.g., Bicycles: 25%). Use the USITC Tariff Database.

Compliance Minefields: Selling kitchenware? California Prop 65 requires lead/cadmium testing. EU mandates REACH for chemicals. Factor 800−800−2,500 for compliance testing per SKU.

| Channel | Best For | Red Flags | Pro Tip |

|---|---|---|---|

| Alibaba | Commodities, High-MOQ Items | Gold Supplier badges ≠ legitimacy | Filter by "Assessed Supplier" with Onsite Check |

| Global Sources | Electronics, Hardware | Overpriced "trading companies" posing as factories | Demand factory floor videos with today's newspaper |

| 1688.com | Native pricing (no export markup) | Mandarin-only interface; payment hurdles | Use a trusted sourcing agent for access |

| Trade Shows (Canton Fair) | Complex, custom products | Post-show ghosting | Get WeChat contacts during the meeting |

Critical: 68% of "factories" on B2B platforms are traders. Verify via:

Business License Check: Use National Enterprise Credit Info Publicity System (Chinese). Look for registered capital scope matching your product.

Satellite Footprint: Cross-check factory addresses on Google Earth. No visible warehouses? Likely a trader.

CTA after Section: "Lost in supplier verification? Our Supplier Audit Service includes onsite checks, license verification, and machinery validation. [Get a Factory Report] (link)"

Step 1: The Scorecard Kill Criteria

Eliminate suppliers failing ANY of these:

❌ No valid business license visible on gov database

❌ Refuses video call showing production floor

❌ Unable to provide 2 verifiable client references

❌ No ISO 9001 certification (for regulated goods)

Step 2: Deep Due Diligence

Financial Health: Request a Credit China Report. Debt ratios >70% signal bankruptcy risk.

Production Audit: Hire a third-party auditor (e.g., QIMA, AsiaInspection). Verify:

Actual capacity vs. claimed (check machine hour logs)

QC process adherence (are gauges calibrated? Are AQL records kept?)

Social compliance (no child labor, safe working conditions)

Download: Supplier Scorecard Template (CSV) with weighted criteria (Quality: 40%, Price: 25%, Communication: 20%, Compliance: 15%).

Guanxi Isn't Fluff – It’s Your Contract

The "Yes" Trap: When a supplier says:

"No problem!" = "I haven’t checked but don’t want to lose face."

"A little difficult" = "Impossible unless you change specs."

Negotiation Scripts That Work:

Pushing Price:

"Your quote is $1.25/unit. Our target is $0.95 based on 50,000pcs MOQ. Can we review the BOM cost breakdown? Perhaps we can adjust plastic grade from Dupont to Sinopec PP?"

(This invites collaboration, not confrontation)

Addressing Delays:

"Wang Laoban, hope you had a good weekend. Per our schedule, pre-production samples were due yesterday. Can you confirm the new timeline? We can adjust logistics if needed."

(Pressure + flexibility)

Holiday Nuclear Winter: Chinese New Year (Jan 29-Feb 7, 2025) and Golden Week (Oct 1-7) shut down supply chains. Rule: Add 4-6 weeks to timelines crossing these dates.

Pro Tip: Send WeChat voice messages for urgent issues. Text gets buried; voice signals importance.

Incoterms 2025: The Landed Cost Killers

| Term | Your Risk | When to Use | 2025 Cost Impact |

|---|---|---|---|

| EXW | Everything after factory gate | Total control; strong China team | +25-40% hidden logistics fees |

| FOB | Goods post-loading at port | Most balanced option | Sea Freight: YOU pay main carriage |

| DDP | Supplier handles all | Simplicity; low volume | +15-30% markup on logistics |

PO Must-Haves:

Spec Annex: CAD files, Pantone codes, ASTM/EN standards

Penalty Clause: "Delay: 0.5%/day of PO value. Defect rate >2.5%: 100% sorting at supplier cost."

IP Protection: "Supplier warrants all molds/tooling are buyer’s property. Serial numbers etched."

The 3-Stage Sample Process:

Prototype Sample: Confirms design/function (~300−300−1,500, lead time 15-30 days).

Pre-Production Sample (PPS): From actual production line, using correct materials. Requires signed approval before mass production.

Golden Sample: Sealed and signed by both parties. Used for QC inspections.

Compliance Fail-Safe: For EU/US markets, require test reports from an accredited lab (SGS, TÜV) before PPS approval.

AQL 2.5 Isn’t Magic – Context Matters

Critical Defects (0 AQL): Safety risks (e.g., exposed wires on a toy). Inspect 100%.

Major Defects (AQL 1.0): Functional failures (e.g., zipper breaks). Standard inspection level.

Minor Defects (AQL 4.0): Cosmetic flaws (e.g., stitching mismatch).

On-Site QC Power Moves:

Pre-Shipment Inspection (PSI): 80% goods completed, packed in cartons.

During Production Check (DUPRO): At 20% completion. Catch issues early.

Container Loading Supervision: Prevent substitution or short-loading.

CTA after Section: "Don’t ship blind. Our Professional Inspection Services include DUPRO, PSI, and loading checks. [Schedule Yours] (link)"

Sea vs Air Break-Even Analysis (2025 Rates)

| Order Size | Sea Freight (Shanghai→LA) | Air Freight (PVG→LAX) | Savings |

|---|---|---|---|

| 2 CBM | $450 | $2,100 | Air: 4.6x costlier |

| 10 CBM | $1,100 | $8,500 | Air: 7.7x costlier |

Landed Cost Formula:

[Product Cost] + [Shipping] + [Duties] + [Tax (VAT/GST)] + [Warehousing] + [Compliance] + [Risk Buffer (5-10%)]

Example: $10,000 goods (EXW Shenzhen) → USA

Ocean Freight: $1,200 (10 CBM)

Duties: 7.5% (Section 301) = $750

CA Sales Tax: 8.5% = $1,021

Compliance Testing: $850

TOTAL LANDED COST = $13,821

CTA after Section: "Need precision? Get a Custom Landed Cost Estimate from our logistics team in 1 hour. [Request Quote] (link)"

The 30/40/30 Scaffolding:

30% deposit after PPS approval

40% upon PSI pass (with photo evidence)

30% 30 days after goods received

Escrow Scam Alert: Fake "Alibaba Trade Assurance" emails mimicking Alibaba.com. Always log in via official site to pay.

Secure Payment Channels:

TT Bank Transfer: For trusted partners (lowest fees)

Alibaba Trade Assurance: Mediation support (fees apply)

Letters of Credit (L/C): For orders >$100k (cost: 1.5-3% of PO)

Build Resilience Into Your Chain:

Dual-Source Critical Components: Qualify a backup supplier. Give them 5-10% of orders to keep them warm.

Route Diversification: Ship via multiple ports (e.g., Shanghai and Ningbo). Avoid single points of failure like the 2025 Red Sea crisis.

IP Protection: Register trademarks with Chinese Customs . They seized 22 million counterfeit goods in 2023 alone.

Disaster Playbook:

PSI Fails: Demand 100% sorting at factory (supplier cost) or negotiate discount (e.g., 30% off for minor defects).

Supplier Bankruptcy: Have mold ownership documents ready. Physically secure tooling within 72 hours.

US Essentials:

FDA: Food/cosmetics require facility registration + prior notice. 2025 Focus: FSVP compliance for food importers.

CPSC: Children’s products need CPC + ASTM testing. Fines up to $120,000 per violation.

FCC: Electronic devices (EMI/RFI testing). Mandatory labeling.

EU Essentials:

CE Marking: Requires Technical File + DoC. 2025 Update: Stricter enforcement for online sellers.

REACH: Test for 241 SVHCs (Substances of Very High Concern).

EPR: Germany’s VerpackG law – register + pay recycling fees.

Compliance Mantra: "Your supplier helps, but YOU are legally liable."

| Country | Strengths | Weaknesses | Ideal For |

|---|---|---|---|

| Vietnam | Footwear, textiles, furniture | Limited electronics ecosystem | Brands leaving China due to tariffs |

| India | Pharma, textiles, IT services | Poor infrastructure | API, generic medicines, software |

| Mexico | Automotive, aerospace | Higher labor costs | US "nearshoring"; JIT delivery |

Diversify When:

China costs rise >15% vs alternatives

Geopolitical risk impacts >20% of revenue

Single supplier dependency >80%

Supplier Scorecard (CSV) – Weighted evaluation matrix

RFQ Template (PDF) – Technical specs + commercial terms

QC Checklist (PDF) – AQL-driven inspection sheets

Landed Cost Calculator (Excel) – Auto-updates with 2025 duty rates

[Download All Templates Here] (link)

Day 1: RFQ sent to 8 suppliers (Alibaba + 1688)

Day 7: 3 suppliers shortlisted. Scorecard + video audits done.

Day 14: Negotiation closed. PO issued (30/40/30 terms).

Day 21: PPS samples approved. Lab tests passed.

Day 45: DUPRO check (20% goods completed). Minor issues fixed.

Day 60: PSI passed (AQL 1.0/2.5). Goods shipped FOB Shanghai.

Day 85: Goods cleared customs. Delivered to warehouse.

Day 90: Final payment released.

| Metric | Target | Why It Matters |

|---|---|---|

| Landed Cost Accuracy | ±5% | Avoids margin erosion |

| On-Time Delivery (OTD) | >95% | Prevents stockouts |

| First-Pass Yield (FPY) | >92% | Reduces QC/rework costs |

| Supplier Defect Rate | <1.5% | Ensures product quality consistency |

1. Q: I found a supplier with great prices but a low transaction volume on Alibaba. Is this a red flag?

A: Not necessarily. Many excellent factories focus on a few large, long-term clients rather than many small orders. A low transaction volume is a yellow flag—prompting deeper due diligence like a video audit and credit check—but shouldn't be an automatic disqualifier. A high volume of small, unrelated orders is often a bigger red flag for a trading company.

2. Q: My supplier is suddenly asking for a 50% deposit instead of 30%, citing "rising material costs." How should I handle this?

A: This is a common pressure tactic. Politely but firmly refer to your signed Purchase Order and agreed terms. Offer a compromise: you'll consider a higher deposit upon seeing official, updated raw material price sheets from their suppliers. Never change financial terms mid-production without receiving tangible verification of the cost increase.

3. Q: What's the single most important document to get from a supplier before production begins?

A: The signed Pre-Production Sample (PPS) approval form. This document, with a physical signed sample attached, is your legal and quality benchmark. Mass production should only start after this is locked in. Any deviation from the PPS later gives you full grounds for rejection or a discount.

4. Q: How do I actually verify a Chinese business license on the National Enterprise Credit Info Publicity System if I don't speak Mandarin?

A: This is a major hurdle. Use the Google Translate mobile app with its camera function to navigate the site. For a more reliable method, hire a local sourcing agent for a small fee to run the report—they can verify the license's authenticity, registered capital, and business scope in minutes.

5. Q: My shipment failed its pre-shipment inspection (PSI). What are my concrete next steps?

A: First, immediately halt any pending payments. Then, you have three options, negotiable based on the failure severity: 1) Demand 100% sorting at the factory at the supplier's expense, 2) Negotiate a steep discount (e.g., 30-50%) to accept the flawed goods, or 3) Cancel the order and demand a refund for any deposits paid (this is hardest, so strong contracts are key).

6. Q: Is Alibaba Trade Assurance actually worth it, or is it just marketing?

A: It's a useful layer of protection for new importers, but it's not a silver bullet. You must follow its strict rules to the letter: all communication and payments must happen on the Alibaba platform, and you need solid evidence (like a third-party inspection report) to win a claim. For larger orders, a Letter of Credit (L/C) is often a more robust financial instrument.

7. Q: Beyond the per-unit cost, what hidden fees should I ask about in an FOB quote?

A: A "FOB price" only covers the product loaded on the ship. Smart buyers explicitly confirm there are no hidden local charges (called "local expenses") like THC (Terminal Handling Charge), document fees, or customs declaration fees. A professional supplier will list these as "FOB Fees" separately (typically $50-150), while a dishonest one will hide them until the last minute.

8. Q: What's the most effective way to get a reluctant supplier to acknowledge a delay?

A: Stop asking "Is it on time?" and start asking solution-oriented questions. Phrase it like: "I need to plan logistics. To confirm, the new shipping date is [propose a date based on your intel]. Please advise so I can book the vessel." This forces them to either agree to your date or finally provide a real timeline, breaking the "yes, yes, soon" cycle.

9. Q: How do I choose between SGS, QIMA, or AsiaInspection for a factory audit?

A: All three are reputable. Your choice should be based on the supplier's location and the auditor's specific expertise. QIMA and AsiaInspection often have stronger networks and faster turnaround for audits in deeper China provinces, while SGS is a global giant excellent for compliance testing. For a simple capacity check, the cheapest option is fine.

10. Q: My product isn't electronic or for children. Do I really need to worry about US compliance?

A: Absolutely. The CPSC (Consumer Product Safety Commission) governs almost all consumer goods. General product safety rules apply, and you are liable if your product causes harm. Furthermore, customs may randomly inspect shipments for labeling (e.g., country of origin) and materials compliance. It's not worth the risk of seizure or lawsuits.

11. Q: The supplier says my molds are "ready" but refuses to send photos with serial numbers etched. What does this mean?

A: This is a major red flag. They likely haven't started the mold, are using it for other clients, or, worst-case, are refusing to acknowledge your ownership. Halt all payments and demand a video call showing the mold with the serial number you specified. Your mold ownership clause in the contract is your leverage here.

12. Q: For a dual-sourcing strategy, is it better to have two suppliers in China or one in China and one in Vietnam?

A: Start with two in China. Managing two supply chains in different countries doubles the complexity (different logistics, regulations, communication styles). First, master the process with a primary and backup supplier in China. Once that system is robust, then consider diversifying to another country like Vietnam for geopolitical or cost reasons.

Deep Dive into Specific Sourcing Niches

This guide has provided a comprehensive overview of sourcing from China. For detailed, actionable strategies within specific industries, explore our dedicated resources:

Textiles & Apparel: China Textile Sourcing: 5 Key Reasons & Actionable Strategies

Garment Manufacturing: How to Source Clothing from China — Practical Guide

Working with Partners: What to Require from a Sourcing Agent in China — SLA, QC Checklist & Contract Clauses

Compare All Options

Each product category has its own unique challenges and opportunities. Leverage our specialized guides to develop a precise and effective sourcing strategy for your business.

Contact us

Call Us: +86 193 7668 8822

Email:[email protected]

Add: Building B, No.2, He Er Er Road, Dawangshan Community, Shajing Street, Bao'an District, Shenzhen, China