China fabric sourcing — Ultimate practical guide for procurement teams

China remains world-class for breadth: from commodity cotton and polyester to advanced technical and recycled fibres.

Choose channels by need: online platforms for wide discovery, market hubs for rapid sampling, and direct mills/agents for scale and compliance.

Make sustainability non-negotiable: require verifiable certificates (GOTS/GRS/Oeko-Tex), supplier traceability, and a remediation plan in contracts.

Use an RFP + supplier scorecard + QC SOP to move from shortlist → pilot → full order. Templates included below.

Key KPIs to track: OTIF, PPM, ESG score, landed cost variance, and corrective-action closure time.

Why source fabric from China? (market reality & risks)

China fabric clusters — what to buy where (regional table)

Channels compared: online / markets / mills / agents

How to select and verify a sourcing agent (practical checklist)

RFP & Supplier Scorecard (copy-ready templates)

Quality control (QC SOP & sampling rules)

ESG & compliance: certificates, audits, and traceability (operational steps)

Landed cost model & sample scenarios

Supplier management: KPIs, SLAs and remediation workflow

Small-batch / low-MOQ strategies

Case snapshot (practical example)

FAQ (practical answers)

China is not a single option — it’s an ecosystem. You get scale, dense supplier clusters, specialized mills, and supporting services (testing labs, finishing houses, logistics). That delivers cost efficiency and speed. But two realities change procurement behavior today:

Fragmentation of risk: political, regulatory, and ESG risks are uneven across provinces and product lines. Cotton-related risks and forced-labour scrutiny require proactive screening.

Buyer expectations: brands now demand traceability, measurable sustainability KPIs, and third-party evidence. That turns “price first” sourcing into a multi-dimensional procurement exercise.

Practical takeaway: structure sourcing decisions by material (cotton, polyester, recycled polyester, blends, technical fabrics) and objective (cost leader vs speed to market vs sustainability-compliant supplier).

| Region / City | Typical fabric types | Strengths | Typical MOQ | Typical sample → bulk lead time |

|---|---|---|---|---|

| Shaoxing (Zhejiang) | Woven fabrics, apparel cotton blends, printed fabrics | Deep weaving & finish houses; strong for mid-to-high quality apparel fabrics | 1,000–3,000 m depending on complexity | Samples 5–14 days; bulk 25–45 days |

| Shengze (Jiangsu) | Knits, technical knits, underwear fabrics | High-capacity knit mills, fast turnarounds | 500–2,000 m | Samples 5–10 days; bulk 20–35 days |

| Guangzhou / Humen (Guangdong) | Garment trims, fast-fashion fabrics, small-batch | Close to ports, ideal for small runs & quick sampling | 100–1,000 m (many sellers support low MOQ) | Samples 2–7 days; bulk 15–30 days |

| Wuxi / Nantong (Jiangsu) | Home textiles, heavier woven | Good for home-linen, jacquard | 1,000+ m | Samples 7–15 days; bulk 30–50 days |

| Zhejiang industrial cluster (Various) | Recycled fibres, performance finishes | Growing capability for recycled polyester/functional finishes | 1,000+ m | Samples 10–18 days; bulk 30–50 days |

Use the table to map buyer needs (speed vs complexity vs sustainability). If you need low MOQ + speed, prioritize Guangzhou/Humen or sourcing agents who can consolidate. For technical or certified fibres, use Shaoxing/Shengze clusters.

Pros: scale, searchable specs, price benchmarking.

Cons: verification overhead; many intermediaries.

Use when: early-stage discovery and price benchmarking.

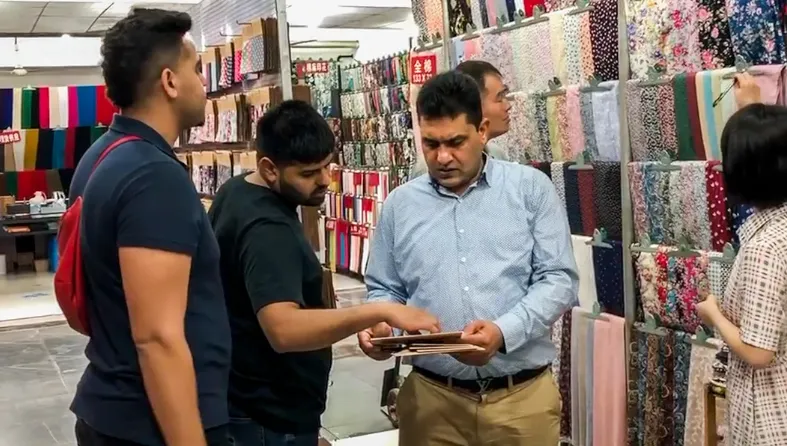

Pros: tactile inspection, networking, quick sample pickup.

Cons: time and travel cost.

Use when: fabric quality, hand-feel or innovation matters.

Pros: best pricing at scale; direct control over production.

Cons: higher MOQs; may lack English or export handling.

Use when: volume contracts, stable SKUs, long-term relationships.

Pros: on-the-ground verification, consolidated sampling, QC and logistics support.

Cons: extra fee, need to vet the agent.

Use when: limited in-house China presence, complexity, or heavy compliance needs.

Channel selection rule: map channel → objective. Example: for a sustainable small-run launch, use agent + Guangzhou for sampling, then scale to Shaoxing for volume production.

Treat sourcing agents like suppliers. Ask for evidence and test them.

Business credentials: state-registered business license scan, tax ID. Verify company name and registration number on official provincial registry.

Client references & use-cases: ask for 3 live clients (contactable). Prefer clients in your geography or similar product categories.

Service scope & SLA demo: get a written description of responsibilities (sourcing, QC, packing, logistics, CA/CO checks) and an SLA example.

Fee structure: fixed fees vs % of FOB vs per-PO. Request sample invoice.

On-site capability proof: short video of plant visits, photo gallery, recent audit reports (if agent conducts audits).

Sample handling process: pick-up timeline, labeling, photo documentation, sample storage policy, transit insurance.

Compliance & traceability practice: how they verify certificates, chain-of-custody approach, digital traceability tools used.

Escrow / payment flow: do they use buyer-friendly payment flows (escrow, milestone payments, documentary evidence)? Get their bank info.

Language & communication test: a live meeting (30 minutes) to assess response quality and negotiation ability.

Pilot order test: assign a small paid pilot (one sample + small run) to validate execution.

Red flags: refusal to provide registration details, vague client references, cash-only or offshore-only payment requests, inability to show current plant photos or videos.

Company name & contact

Product description (composition %, GSM, finish)

Construction & technical spec (weave/knit type, thread count)

Colour(s) & lab-dip instructions

Width (cm) & tolerance

Weight (GSM) & tolerance

Shrinkage tolerance (%) & shrinkage testing method

Physical tests required (colorfastness, pilling, tensile, etc.) — specify test standards & lab.

Sample requirements (swatch, lab-dip, strike-off, pre-production sample)

MOQ & price tiers (FOB / EXW)

Payment terms & documentation (LC/TT, deposit %)

Lead times (sample / bulk) & shipping INCOTERM

Packaging & labeling requirements

ESG & compliance requirements (certificates required, audit frequency)

Warranty & defect allowance (AQL level)

Penalties for late delivery / non-conformance

Confidentiality & IP clauses

| Criteria | Weight | Supplier A (score/100) | Supplier B (score/100) |

|---|---|---|---|

| Quality (lab results, inspection) | 30% | 78 | 84 |

| Delivery & lead time (OTIF) | 20% | 85 | 70 |

| Price competitiveness | 15% | 80 | 88 |

| ESG / compliance (certs + audit history) | 20% | 60 | 95 |

| Communication & responsiveness | 10% | 90 | 75 |

| Flexibility (MOQ, color runs) | 5% | 70 | 65 |

| Weighted score | 100% | 78.5 | 81.75 |

How to use: adjust weights to reflect your priorities (e.g., sustainability-heavy buyer: increase ESG weight to 30–35%).

Sample hierarchy

Swatch / hand sample: initial feel, color.

Lab-dip / color match: digital & physical confirmation.

Strike-off / lab sample: first print/finish attempt.

PP sample (pre-production): full-construction sample with trims.

Pre-shipment sample: from the actual bulk production.

QC checkpoints (minimum)

Incoming material inspection: verify composition, GSM, width, defects per meter.

In-process checks: key control points (dyeing, finishing, cutting) — documented checks at 30%, 60% and 90% production.

Final inspection (AQL): follow ISO 2859 / AQL sampling plan. For critical apparel components, use stricter AQL (e.g., 1.5%).

Lab testing: colorfastness tests, shrinkage, pilling, composition verification (FTIR for synthetic blends if needed).

Packaging & labeling verification: ensure carton specs, inner packing and shipping marks meet buyer’s requirement.

QC Checklist (compact)

Order/spec verification: ✅

Lab-dip approved: ✅ (date + approver)

In-line inspection records: % complete / issues logged

Final AQL inspection result: P/F + defect count per category

Lab test reports attached: ✅ (include lab name & report number)

Photos of bulk rolls: included ✅

Carton & pallet packing check: ✅

Example defect KPI: PPM (parts per million) target <500 for initial supplier; trend to <100 for established suppliers.

1. Set minimum certificate baseline in RFP

Example: for organic cotton items — require GOTS certificate for factory or raw material supplier; request certificate number and validity. For recycled polyester content, request GRS or equivalent.

2. Verify certificate authenticity

Ask for certificate scans and certificate numbers. Cross-check with certifier’s online database (GOTS/GRS/Oeko-Tex). Note: certifier databases show validity and scope—confirm the scope includes the relevant facility and product type.

3. Social compliance

Demand at least one recent audit (SMETA or BSCI) within past 18 months for high-risk suppliers. Request CAP (corrective action plan) and proof of closure for past non-conformities.

4. On-site verification & digital evidence

Use agent or third-party inspector to obtain time-stamped photos, videos, and production line footage. For higher assurance, ask for CCTV or real-time walk-through with an on-site contact.

5. Traceability & chain-of-custody

Insist on mill-to-mill traceability for high-risk fibers. Use batch numbers, raw material invoices, and transport docs. For premium claims (organic/recycled), require documented chain of custody.

6. Contractual levers

Insert ESG KPIs with remediation timelines and financial consequences (e.g., holdbacks, termination triggers). Require third-party audit rights.

7. Continuous monitoring

Use periodic desk reviews, annual audits, and random spot checks. Track supplier ESG score on the same cadence as quality KPIs.

Core building blocks

Raw fabric FOB / EXW price per metre

Inland transport to port / container consolidation cost

Export duties (rare for textiles from China)

Freight (FCL vs LCL vs air)

Insurance (marine / cargo)

Import duties & VAT in destination country

Customs clearance & local trucking

QC & testing costs

Agent fees & handling charges

Sample scenario — small illustration (numbers are illustrative; run your own quotes)

1,200 m of mid-weight cotton @ FOB $3.20/m = $3,840

Inland + consolidation = $120

Ocean freight FCL share = $200

Insurance = $10

Import duty (5%) = $192

Customs clearance & local trucking = $150

QC & lab tests = $120

Estimated landed cost = $4,832 → per metre = $4.03

Use a spreadsheet template to model multiple scenarios (air vs ocean, different MOQs).

Core KPIs

OTIF (On Time In Full) — target 95%+ for established suppliers.

PPM / defect rate — initial aim <500 PPM; mature suppliers <100 PPM.

ESG score — composite metric (certs, audit score, remediation closure rate).

Landed cost variance — actual vs target (%).

Corrective Action Closure Time — days to close CAP.

SLA sample clauses

Delivery: Supplier must meet agreed lead time ± 5%; late deliveries beyond 7 days trigger penalty of 0.5% per week up to 3% of PO value.

Quality: Batch failing AQL must be rectified at supplier cost within 15 days, or buyer may reject and source elsewhere.

ESG: Failure to remedy a critical audit finding within 45 days is grounds for contract termination.

Remediation workflow

Issue NC report → 2. Supplier root cause analysis within 7 days → 3. Corrective Plan within 10 days → 4. Verification audit within 30–45 days → 5. Close or escalate.

Order consolidation: use agent to combine orders for different buyers into larger runs to meet MOQ and split later.

Roll pooling: negotiate partial roll purchase or remnant roll options for prototypes.

Local finishing houses: do small finishing runs locally to reduce MOQ from main mill.

Higher unit price acceptance for speed: accept higher per-metre for low MOQ but short lead time; formalize using pilot pricing.

Problem: European D2C brand needed 8 SKUs of lightweight organic cotton tees with low MOQ (2,000 units total), traceability, and GOTS compliance.

Action: engaged a China sourcing agent to shortlist 5 mills; ran an RFP asking for GOTS certificate, OTIF evidence, and pre-shipment lab tests. Two factories passed scorecard. Agent negotiated sample runs in Guangdong cluster with consolidated shipping. Pilot run (500 units) validated quality; full run scaled to Shaoxing mill with GOTS-verified raw-material invoices.

Result: time to first shipment cut from 90 days to 55 days; landed cost within 6% of target; ESG documentation passed audit.

Why it worked: clear RFP, agent consolidation, strict scorecard weighting for ESG and OTIF.

How do I verify a GOTS certificate?

Get the certificate number and check the issuing body’s public database. Confirm scope includes the facility and product. Ask for raw material invoices that match the lot number.

What is a reasonable fee for a sourcing agent?

Typical models: 3–8% of FOB; or fixed monthly retainer + per-PO fee. Choose based on service scope and risk mitigation value.

How long are fabric samples normally?

Swatches: 2–5 days. Lab-dips/strike-offs: 5–14 days. PP samples: 10–21 days depending on complexity.

How to reduce MOQ?

Consolidate orders, buy remnants, negotiate split-pallets, or use an agent that aggregates demand.

Which tests are mandatory?

Depends on market: colorfastness, shrinkage, composition, and flammability for certain products. Always align tests to destination import rules.

Can I trust Alibaba suppliers?

Treat Alibaba as discovery. Always run the RFP, request credentials, ask for on-line verifications, and use a paid inspection before shipment.

What is a typical OTIF target?

95%+ for mature suppliers. For new suppliers set realistic ramp targets and measure improvement.

How often should audits be done?

High-risk suppliers: annual on-site audit. Medium-risk: every 18 months. Supplement with spot checks.

How to manage currency/payment risk?

Use milestoned payments, LC for high-value orders, or escrow for pilot runs.

How to handle a failed pre-shipment test?

Isolate the lot. Request corrective action and re-test. If unacceptable, reject and insist on rework at supplier expense or request replacement shipment.

Publish a clear RFP with ESG and test requirements. ✅

Run supplier scorecard with weights that reflect your priorities. ✅

Use one pilot order before scaling. ✅

Require certificates + verifiable audit reports. ✅

Insert ESG KPIs and remediation clauses into contract. ✅

Track OTIF, PPM, ESG score monthly. ✅

Contact us

Call Us: +86 193 7668 8822

Email:[email protected]

Add: Building B, No.2, He Er Er Road, Dawangshan Community, Shajing Street, Bao'an District, Shenzhen, China